Golden Opportunity: Investing in Portugal through the Mercan Hospitality Investment Fund

Portugal continues to position itself as one of Europe’s most attractive destinations; not just for tourism, but for investors seeking secure, high-potential opportunities tied to the country’s growing hospitality and real estate sectors. The Mercan Private Equity Fund I (MPEF I) offers a unique gateway for investors looking to qualify for the Portuguese Golden Visa while capitalising on a professionally managed venture capital structure. This fund stands out by channelling investments into the hospitality industry, aligning with global demand and economic growth in Portugal.

Featured Developments: ALVOR Beach Resort, Bridgeview Gaia Hotel, and Ponte Do Vau Beach Resort – key hospitality projects under the Mercan Hospitality Investment Fund.

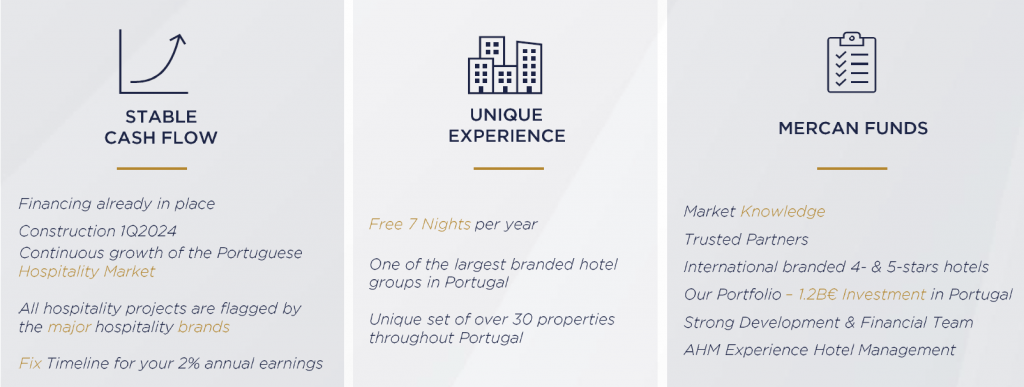

Key Highlights

- Golden Visa Eligible: MPEF I qualifies under Portugal’s Golden Visa framework as a venture capital fund, not a real estate investment.

- Backed by Global Brands: Projects under the fund operate under prestigious hotel chains such as Hilton, Marriott, IHG, Wyndham, and Hard Rock.

- €1.2 Billion Projected Development Value: The fund is part of a broader portfolio contributing significantly to Portugal’s tourism infrastructure.

- Targeted ROI with Buyback Assurance: Offers a structured return backed by SPV companies with a defined buyback clause.

Achievements of the Fund

The Mercan Hospitality Investment Fund has rapidly gained recognition due to its impressive portfolio and strategic market positioning:

- It currently holds or will hold majority stakes (90%) in three key SPV companies operating in Portugal’s thriving hospitality and tourism sector.

- The fund is aligned with Mercan Group’s proven track record, which includes over a dozen projects across Portugal and over €1.2 billion in cumulative value.

- Affiliated developments are located in high-demand areas, strategically targeting Portugal’s estimated 30 million+ annual visitors.

Requirements to Qualify for the Fund

To participate in MPEF I under the Golden Visa scheme, investors must:

- Commit a minimum investment of €500,000 into the fund.

- Maintain the investment for a minimum of 5 years to retain Golden Visa eligibility.

- Meet the eligibility criteria established by Portuguese immigration authorities, including clean criminal records and proof of legal funds.

Investment Earnings and Timeline of ROI

- Expected Duration: The fund operates on a 6-year timeline (including an optional 1-year extension).

- Return on Investment: The appraisal margin indicates a promising ROI; a total fund appraisal of €174.93M versus a €140M capital investment.

- Investor Alignment: Mercan itself has invested €14 million in the fund, signalling strong alignment of interest between the fund manager and investors.

- Projected Earnings: Investors may benefit from both the Golden Visa privileges and a capital return at fund maturity through guaranteed buyback by SPVs.

Security of the Investment

MPEF I offers an attractive level of security rarely matched in similar visa-eligible funds:

- Guaranteed Buyback: As outlined in the investor agreement, the SPV companies commit to a guaranteed buyback of investor shares.

- Majority Control in SPVs: The fund maintains 90% ownership in each project vehicle, with Mercan holding the remaining 10%.

- Risk Mitigation: The fund’s structure and SPV model provide a clear framework for investor protection, offering transparency and built-in exit strategies.

Mercan Private Equity Fund I presents a rare blend of lifestyle, investment, and residency opportunity, offering both strong financial potential and a path to European residency through Portugal’s Golden Visa. With projects anchored in the booming hospitality sector and managed by seasoned professionals, MPEF I stands as a compelling option for global investors seeking long-term value and strategic stability.

If you're interested in learning more about hospitality investment opportunities or would like personalised guidance, feel free to get in touch with us — our team is here to help.